Poloniex Margin Trading, Benefits To Minimum Capitalized Traders

Margin trading is basically trading with loan funds or not our own funds. When we place the margin order, all the money we use is borrowed from other users who offer their funds as peer-to-peer loans. The funds in our margin account are only used as collateral for this loan and to pay off the debt to the lender.

If we are new to margin trading, there will be some terms and concepts that we may not be familiar with. We can see the look for margin trading in poloniex first to be able to better understand about margin trading.

With the addition of margin trading in poloniex, we now have three separate accounts where we can store our funds in three different places:

poloniex margin trading

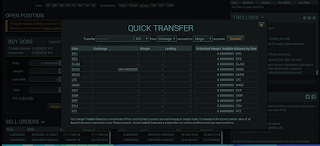

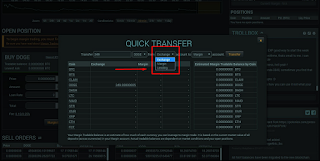

Before we do Margin Trading we must first transfer the funds we have in exchange to margin trading account in the balance transfer page.

We will get loan fund in margin trading with market which margin trading we activate, see example picture below.

When we borrow funds and make trades, positions will open. If we make a purchase it will be called a long position or long position. If we do the seller then called the short position or short position.

Note that when we will continue trading / exchange, our position may change; example, if we sell or short position 300 XMR, but then buy or long position 600 XMR, then our position will be long or long position. When we close our positions, then our loan funds will change automatically.

If we close our position of profit / profit position, the profit we get will be credited to our margin account; but if we close our positions at loss position, then the amount needed to complete our loan will be deducted directly from our margin account.

When we open a position, then we will see a graph like below, please understand well:

Position: Long or short.

(Understanding Margin Trading above is translated directly from the website poloniex.com if there is a language that is not understood can directly read on poloniex.com website)

More or less Margin Trading is a loan fund that we can use to buy or sell, but this loan is only for the funds we transfer to our margin account example we transfer 0.1 btc then the existing funds in margin trading account becomes 0.2btc, so very useful for small capital traders.

Understand the market at the time of this trading to avoid losses because it does not analyze the market properly, any result of the loss or profit that we can on margin trading will be deducted for interest cost from our loan in margin trading, So if we experience losses in trading at margin trading account will double the loss because it will experience a reduction in balance due to pay interest costs also if you experience a profit, will still be charged interest.

Hopefully this post can provide benefits for traders.

If we are new to margin trading, there will be some terms and concepts that we may not be familiar with. We can see the look for margin trading in poloniex first to be able to better understand about margin trading.

With the addition of margin trading in poloniex, we now have three separate accounts where we can store our funds in three different places:

1. Exchange / Exchange

Funds in exchange / exchange accounts are used for regular exchange trading as usual2. Margin / Margin Trading

The funds we have on margin trading are used as collateral to secure the loan used in margin trading3. Loan / Lending

Our funds in the loan / loan account can lend to other users and we earn interest on it.poloniex margin trading

Before we do Margin Trading we must first transfer the funds we have in exchange to margin trading account in the balance transfer page.

We will get loan fund in margin trading with market which margin trading we activate, see example picture below.

When we borrow funds and make trades, positions will open. If we make a purchase it will be called a long position or long position. If we do the seller then called the short position or short position.

Note that when we will continue trading / exchange, our position may change; example, if we sell or short position 300 XMR, but then buy or long position 600 XMR, then our position will be long or long position. When we close our positions, then our loan funds will change automatically.

If we close our position of profit / profit position, the profit we get will be credited to our margin account; but if we close our positions at loss position, then the amount needed to complete our loan will be deducted directly from our margin account.

Position: Long or short.

- Amount: The net amount of the market or market currency that we have bought or sold. If our position is short (sell / sell), this value will be negative.

- Base Price: The approximate price at which you will need to close your position to earn a BEP (break even point).

- Est. Liquidation Price: It is estimated that the highest bid (if our position is long) or lowest (if our position is short) where forced liquidation will occur. Please note that this is only an estimate and has no relation whatsoever at the time of forced liquidation will actually happen. The real price at which forced liquidation will occur is unpredictable with complete accuracy, as it depends, inter alia, on the size and number of open positions and orders, the current value of your collateral, and the current market and the order book conditions. View the Margin Account to learn more about what determines the time of forced liquidation.

- Unrealized P / L: Our estimated profit or loss will be charged if our position is closed. Including borrowing costs to be paid if our position is closed.

Unrealized Lending Fees: The estimated cost of the loan is currently open. - Action: Choose "Close" to close your position with market order.

(Understanding Margin Trading above is translated directly from the website poloniex.com if there is a language that is not understood can directly read on poloniex.com website)

More or less Margin Trading is a loan fund that we can use to buy or sell, but this loan is only for the funds we transfer to our margin account example we transfer 0.1 btc then the existing funds in margin trading account becomes 0.2btc, so very useful for small capital traders.

Understand the market at the time of this trading to avoid losses because it does not analyze the market properly, any result of the loss or profit that we can on margin trading will be deducted for interest cost from our loan in margin trading, So if we experience losses in trading at margin trading account will double the loss because it will experience a reduction in balance due to pay interest costs also if you experience a profit, will still be charged interest.

Hopefully this post can provide benefits for traders.

Posting Komentar untuk "Poloniex Margin Trading, Benefits To Minimum Capitalized Traders"